Flexible, fast and fully online

Enable obtaining a loan and completing the transaction in just 15 minutes. Using e-instalments does not require leaving your home, a courier's visit and additional formalities. A convenient instalment schedule allows the customer to spread the repayment over a period of 3 to 36 months, encouraging higher value purchases.

Enable nowTransaction flow

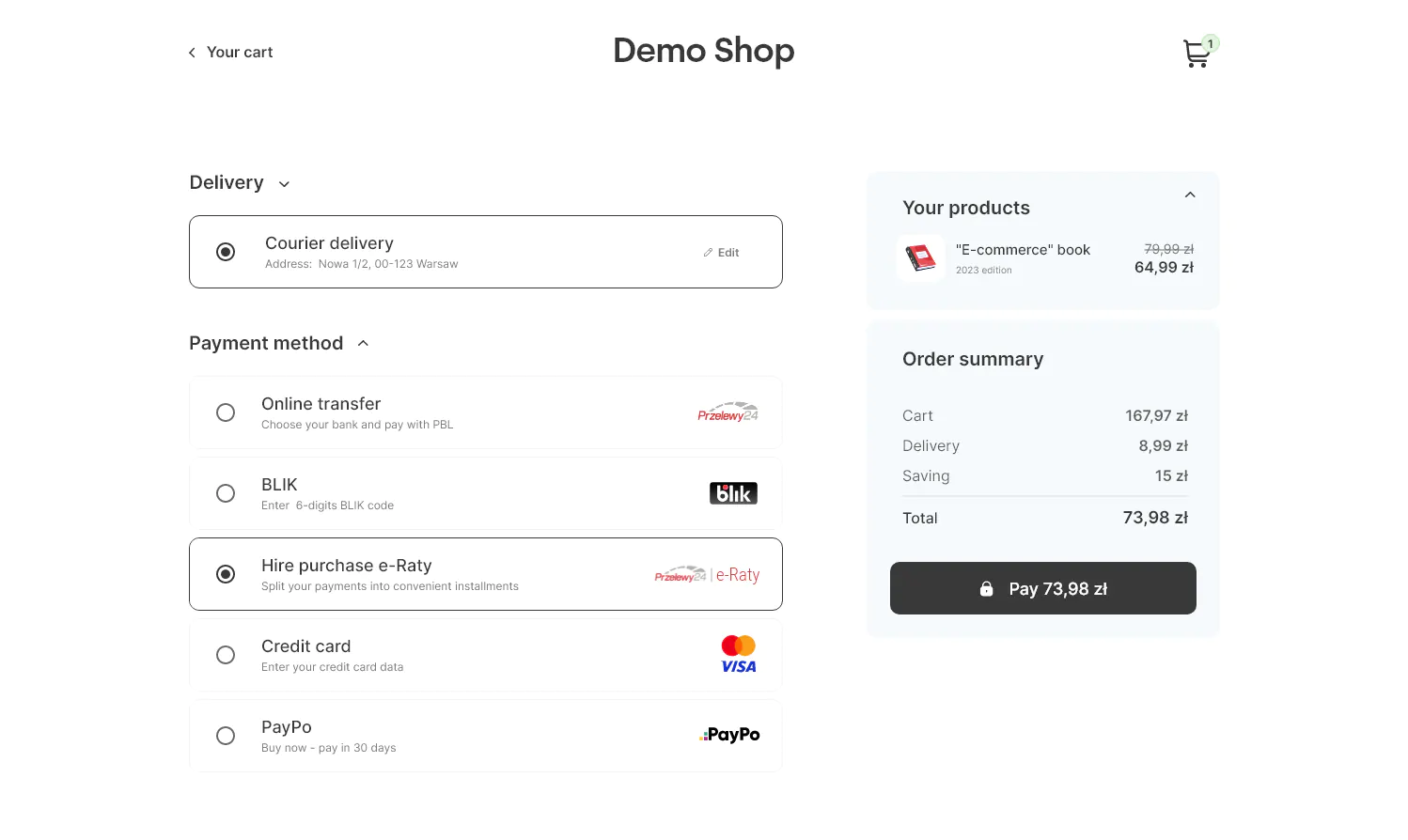

Choosing e-Raty

The customer is redirected to the bank's website to fill in a loan application form.

Verifying the loan application

Following a positive verification, the customer accepts the conditions of an online loan agreement.

Completing the transaction

The loan is financed by the bank, and the funds go directly to the Merchant.

Benefits for buyers

Flexible loan periods

The customer may spread the instalment repayment over 3-36 months.

Speed

The average time from application submission to a positive decision is about 15 minutes.

Fully online

No unnecessary formalities or courier visits.

You gain

Handy tools

An instalment calculator in your store makes your offer even more attractive.

Immediate settlement

The full amount of the transaction is immediately transferred to the Merchant. The customer pays the instalments to the bank.

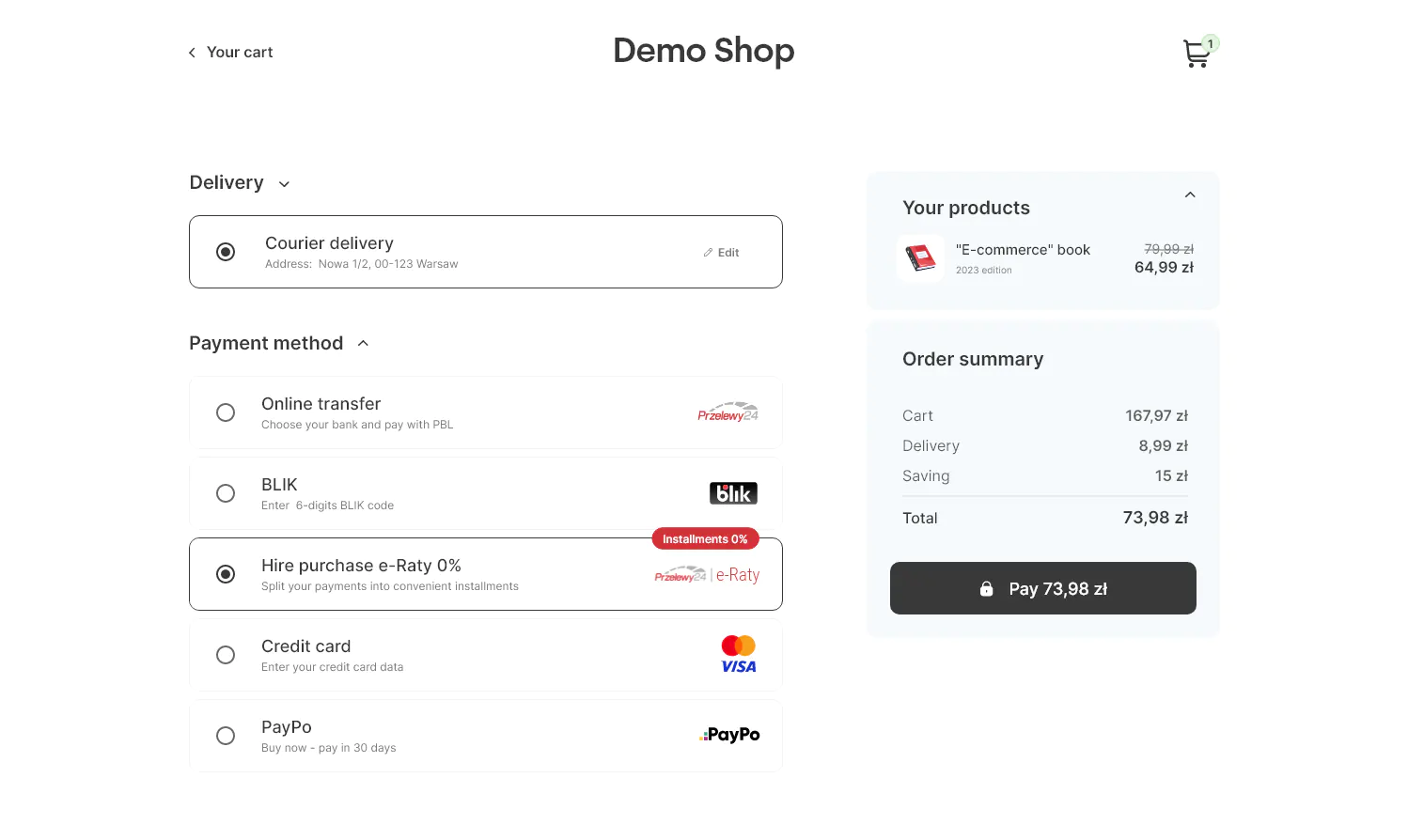

Promotion possibilities

This payment method allows you to run 0% interest rates promotion campaigns.

Meet our payment methods

BLIK

Fast and secure payments with a six-digit code generated in a banking app or in the One Click model.

Go to BLIK

Payment cards

Enabling Visa and MasterCard payments offers further possibilities: multi-currency transactions, subscriptions and recurring payments.

Go to Payment cards